21+ mortgage note buying

Web Mortgage note investing is the process of owning real estate without managing it or becoming a landlord in which the homeowner pays the investor rather than the bank. Note investing can be an incredible vehicle for building passive income but there are many things that you should.

How To Buy Performing Non Performing Mortgage Notes

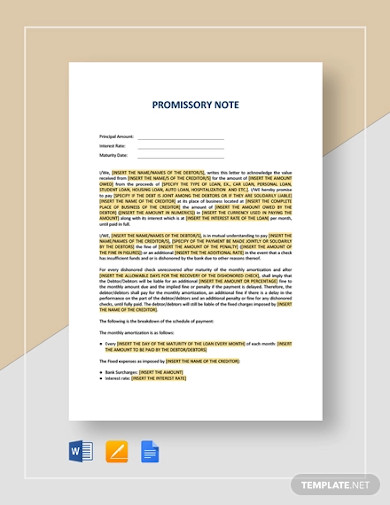

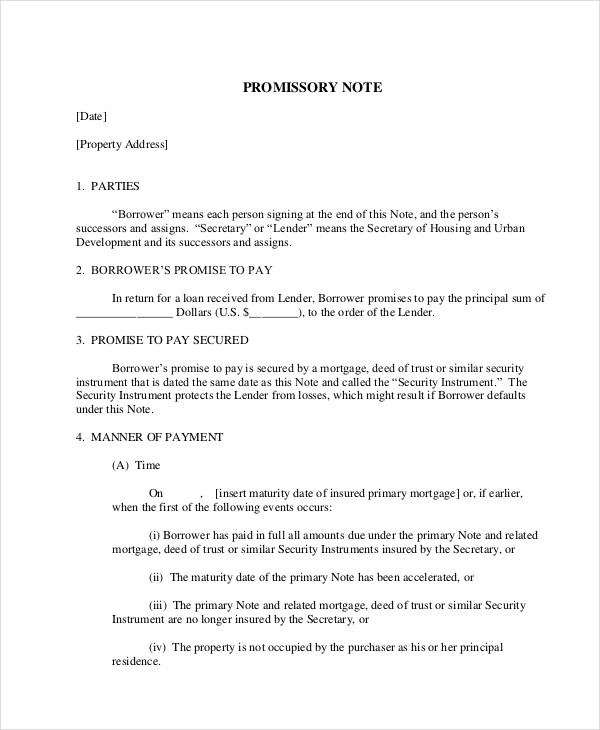

Web A mortgage note or promissory note is the promise to repay the debt.

. Web A mortgage note is a legal document that you sign when closing on a mortgage. On the 10-year Treasury note falling from near. Payment histories typically determine a notes status.

Web A mortgage note is a legally binding contract that should include all the terms and conditions of the mortgage as agreed upon between you and your lender. When we buy a note we first complete a note analysis to evaluate a notes performance and assess its current market value. Listing a mortgage note for sale on Paperstac is free and they charge a nominal fee of 1 for successful sales.

Web When looking to sell a mortgage note there are a few steps that can be taken to help make the process as simple as possible. The mortgage also known as the security instrument pledges the property as collateral to ensure the performance on the obligation. In this order here are the 4 steps leading up to note purchase.

Web Mortgage rates dropped this week in the wake of several bank failures reversing course after rising half a percentage point over the past month. The cost will vary based on several factors including the age of the note payment history loan-to-value ratio and more. The bank holds onto the note and ensures its followed.

Web Points should be rolled up into total interest in order to accurately calculate overall ROI from a note investment. Web A mortgage bank note is a document signed at the end of a home closing an agreement between the borrower and a lender. The lender charges 3 points to the borrower.

Most real estate mortgage note funds generally are low initial investment thresholds. Its typically not more than 200 to. See how it works and what it includes.

Gather the necessary information from your mortgage note and familiarize yourself with the details such as the amount the length of time and interest rate. We originate and service a variety of loans to borrowers from manufactured home retailers mortgage brokers and directly to consumers all over the USA. As the name suggests it represents the borrowers promise to the note holder lender that they.

The note states all the details of the loan including. EXAMPLE A 100000 note with a 3-year term has an interest rate of 6. Apply for a manufactured home loan today.

Web A mortgage note or promissory note is a legally binding document that you sign at closing promising to repay the home loan to your lender. A mortgage note is a document of collateral how a borrower says they want to repay a loan. Finding Real Estate Notes to Buy.

Nonperforming notes are when the debtor has fallen behind in payments Polakovic says. Lower Initial Investment Threshold. They have digitized the entire process from listing notes for sale through negotiations contracts notary and shipment.

In other words if your lender told you that you would be charged an interest rate of 5 but your mortgage note says 525 you will be charged 525 unless you challenge the. This legal document describes the amount of the loan and terms of repayment including duration and interest rate. Web A mortgage note is simply a promissory note used exclusively in real estate transactions.

See What You Qualify For 0 Type of Loan Home Refinance Home Purchase Cash-out Refinance NMLS 3030 What Does A Mortgage Note Look Like. Web Performing mortgage notes are when the borrower is current on the payment. The mortgage allows the lender to take possession of the real estate in the case of a default while the note is the borrowers promise to pay back the loan.

The mortgage note consists of a promissory note and a mortgage or deed of trust. It is a consistent way of making money on a property without having to become a landlord. Web Mortgage note investment funds offer investors a way to diversify their financial portfolio.

Web Mortgage notes are a type of promissory note that details repayment of a loan used to purchase real estate. Find them Qualify them Negotiate a purchase price Fund them. The note spells out the terms such as interest rate payment amount and other such stipulations.

Its the document that states how youll repay your loan and it uses your home as collateral. Web A mortgage note provides a description of the mortgage. Web A real estate note also called a mortgage note is a promissory note associated with a mortgage or deed in trust.

A note thats consistently repaid according to loan terms. Web 21st Mortgage Corporation is a full service lender specializing in manufactured and mobile home loans. You need to know what youre looking for.

Knowing the differences helps when its time to buy loan notes. Web A mortgage promissory note is categorized by loan type loan provider lien position performance and asset class. Web The four steps to buying mortgage notes.

Performing or non performing notes. Borrower name and address Loan amount Loan term Interest rate Late charge The county doesnt get the mortgage note its not recorded. The primary statuses are.

LOAN TYPE Secured When a tangible asset like a property or a vehicle is tied to a lien its called a secured loan. The extra return in the form of points pushes the simple annualized ROI from 6 to 7. It is a low-cost method of investing in real estate.

Nonperforming notes are sometimes. Web A real estate note or mortgage note is similar to a promissory note which is a written promise or obligation to pay a specific amount with interest within a specific time frame. Web A note also known as a promissory note is a legally binding written promise that outlines a loans repayment terms and timelines.

Web A mortgage note is actually a note secured by a mortgage loan. In a private mortgage the borrower makes payments to a private person or entity directly. If you own a home and you bought that home by taking out a mortgage loan from a conventional lender there is a note attached to it which spells out the specific terms.

Web Most mortgage note investments range from 20000 to 50000 per note. First you need to find them. Web Anyone can buy and sell mortgage notes on Paperstac.

How To Buy Mortgage Notes Note Investor

Mortgage Note Investing Top 5 Must Do Due Diligence Youtube

How To Buy Mortgage Notes Note Investor

How To Buy Mortgage Notes Note Investor

21 Printables To Help You Organize Your Life Home

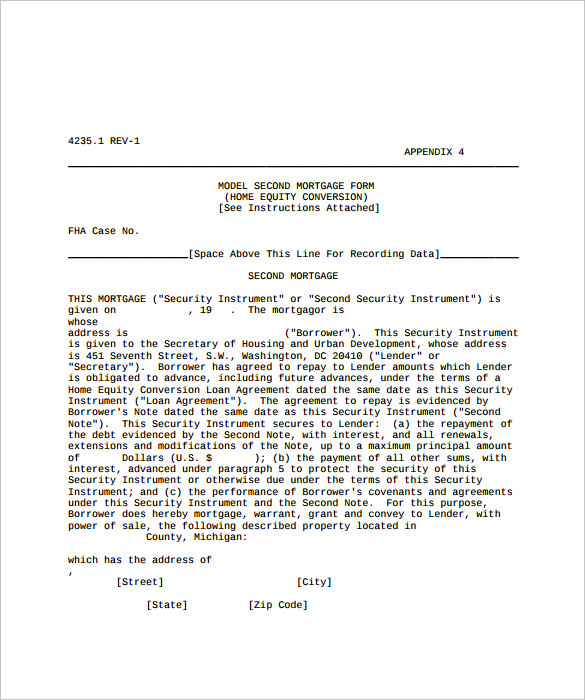

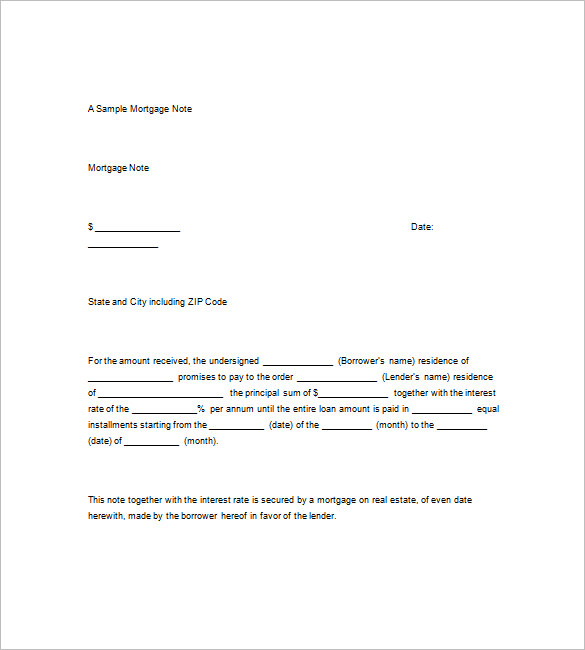

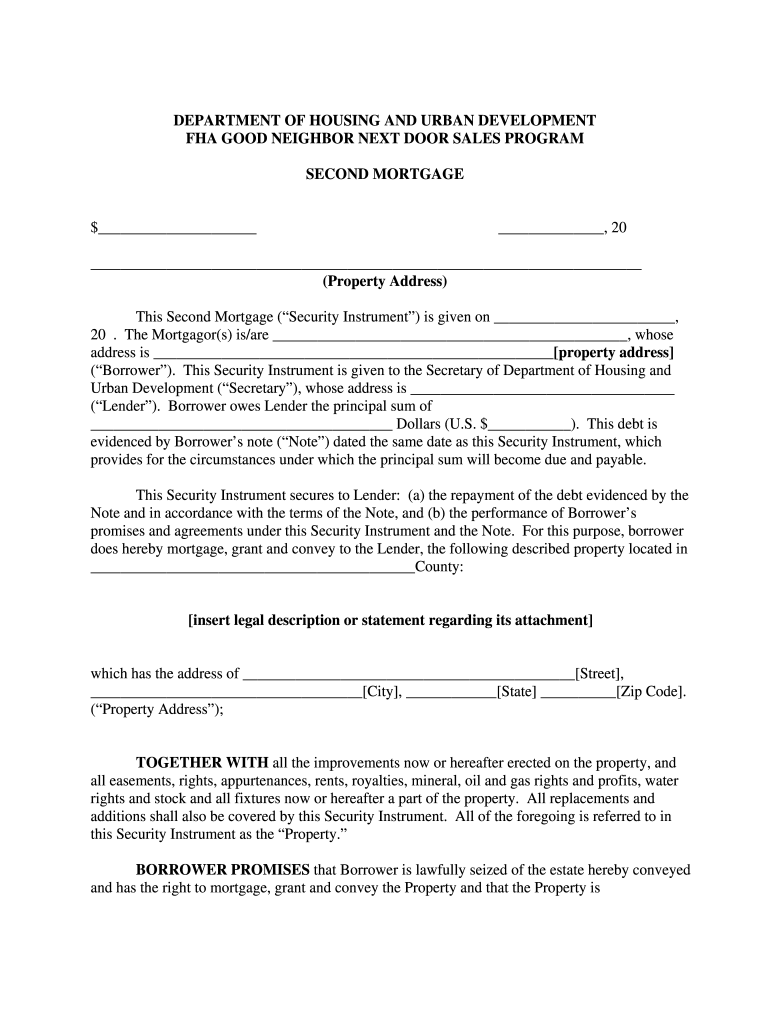

Mortgage Note Templates 6 Free Word Format Download

Where To Buy Mortgage Notes The Ultimate List Of Mortgage Notes For Sale Garnaco

Mortgage Promissory Note 6 Free Word Excel Pdf Format Download

Free 10 Note Purchase Agreement Samples Promissory Convertible Mortgage

5 Best Companies That Buy Houses For Cash In Tampa Fl

Hollxtqcgmygjm

Loan Lender Fill Online Printable Fillable Blank Pdffiller

How To Buy A Mortgage Note From The Bank

Promissory Note 19 Examples Format Pdf Examples

Mortgage Note 6 Examples Format Pdf Examples

Is Buying Mortgage Notes A Good Investment In 2021 Garnaco

1135 Bragdon Rd Wells Me 04090 Realtor Com